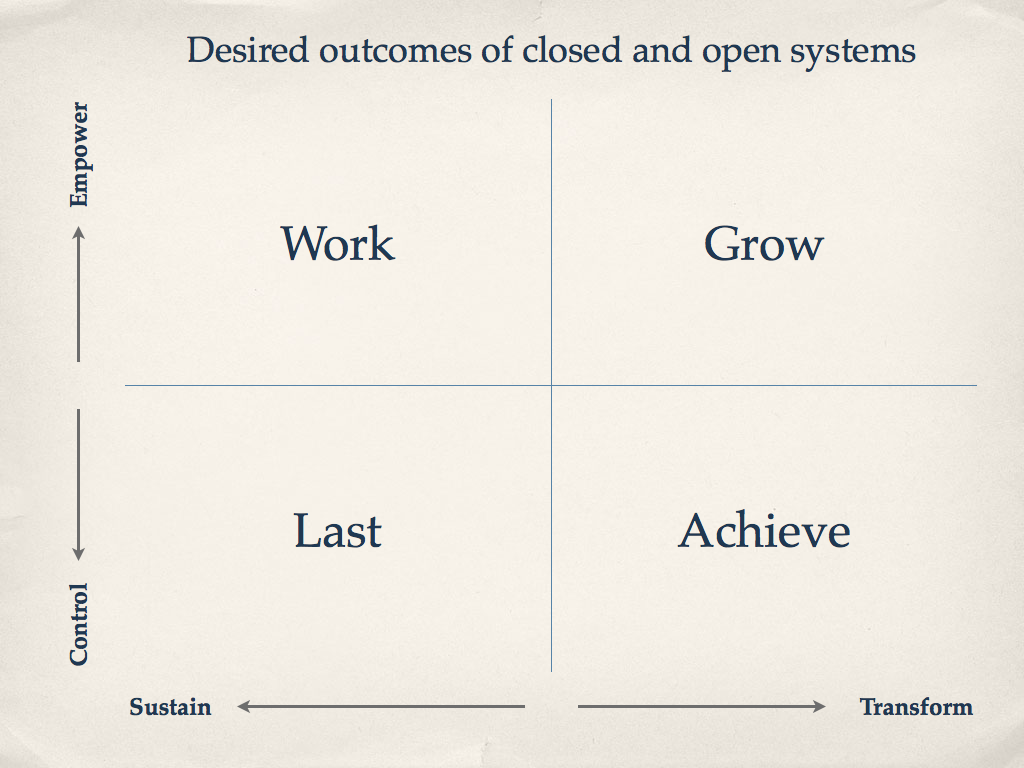

I’ve been exploring some of the implications of openness at large scale and identifying how value is created.  One way to think about that is by positioning openness and empowerment against control and ownership.

When does control create value? What characteristics do the opposite extremes have in common? Â What does success mean in a world that is constantly changing at seemingly increasing speed?

By ‘control’ I mean owning and defining product design, materials, rules, behaviors, processes, marketplace, pricing, etc. as opposed to ’empowerment’ which is all about fueling strength in others.

When you then compare that spectrum against a related tension in the world, change vs the status quo, some interesting things start to appear.

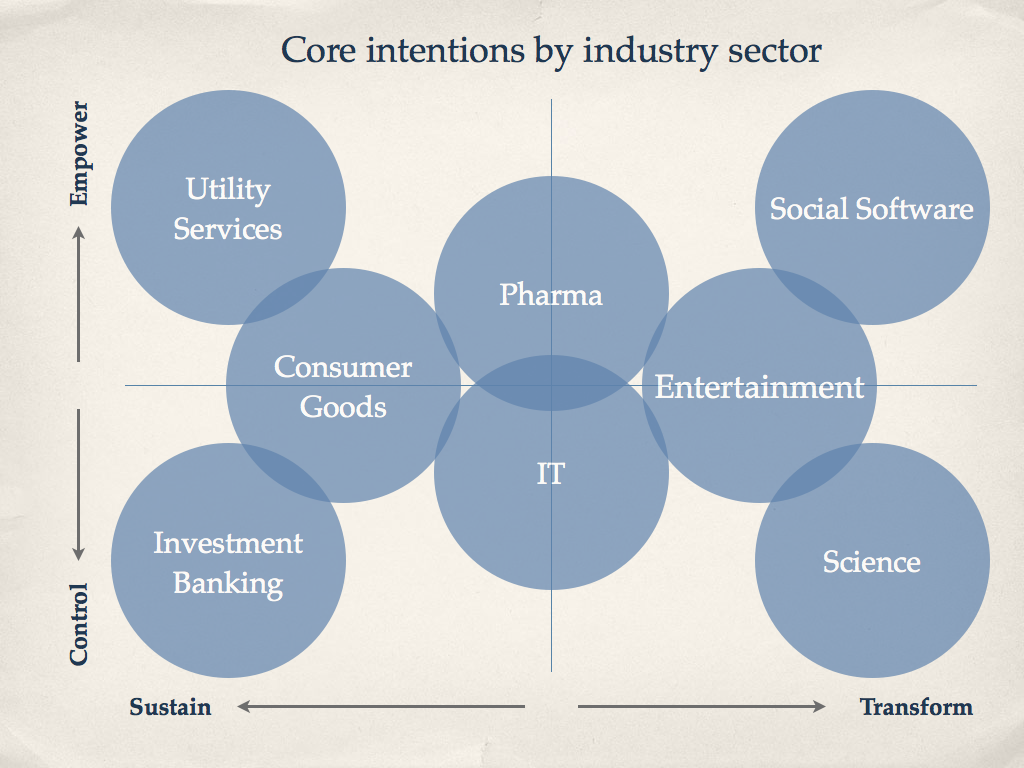

Here is a very generalized view of where certain industry sectors sit on this scale, in my mind.  None of this is based on real data or research.  It’s still just a working hypothesis.

I’m saying here that sectors like Finance and Manufacturing represent the status quo, industries where its customers want incremental change, if any at all.  By this measure, maintaining known outcomes through tumultuous times requires control of resources, distribution, etc.

Utility services similarly want to keep things in a sustainable state and reject transformative change. Â The Utilities marketplace differs from Finance in that its success is dependent on how well it serves people’s needs as opposed to predetermining outcomes for people.

On the other side is Science where its core purpose is defined by the constant pressure to discover new, transformative ways of understanding the world. Â Achieving success requires a great deal of control over details that only individuals and small teams can manipulate, often with great secrecy.

On the other hand, social software enables similarly transformative capabilities in the world, but its customers are empowered to make those changes happen, albeit very chaotic. Â These organizations are defined by their own customers.

The argument then goes that success in each of these categories has slightly different characteristics but signficantly different core purposes.

What do people, business, industries want?

Some aim to sit safely and last as long as possible, while others want to do things and to be busy. Â Some want to achieve or accomplish something new and important, and others want to grow toward something meaningful and to progress.

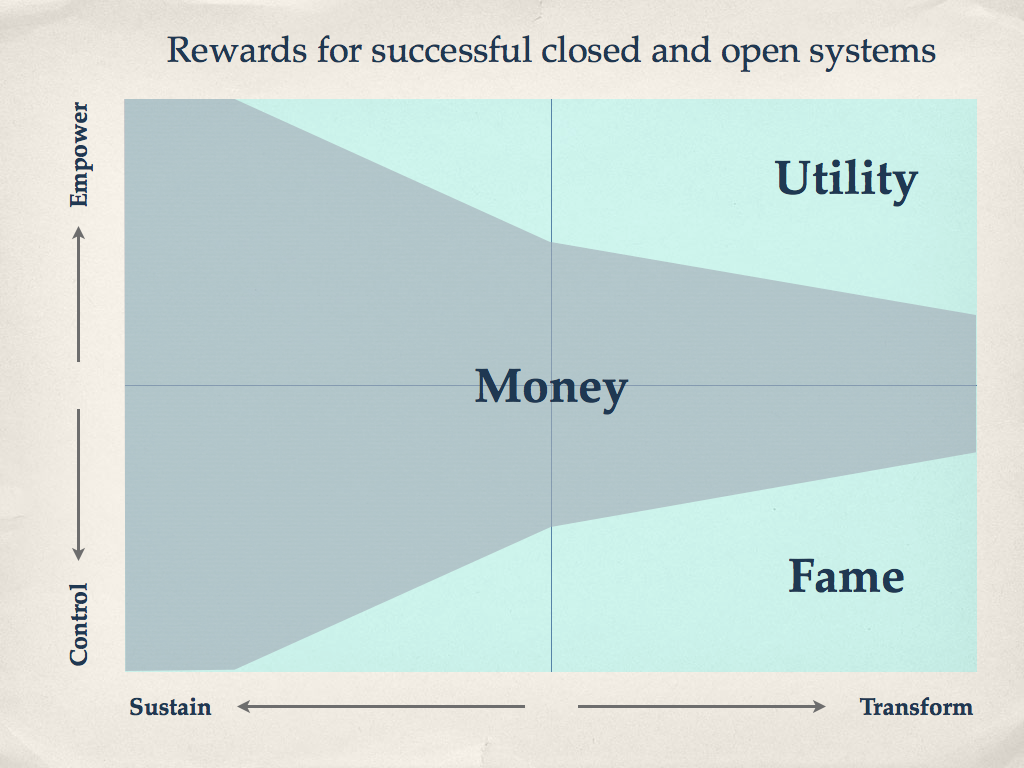

In the industrialized world, the reward for succeeding has traditionally meant cash money. Â Historically, bigger financial rewards find their way to those who are able to sustain behaviors as opposed to those that intend to transform our world.

But not everyone does what they do primarily for cash reward. Â Some do it for the recognition. Â Others do it to be useful.

While fame and utility are strong incentives for many, money has very powerful gravitational pull, particularly at larger scales.

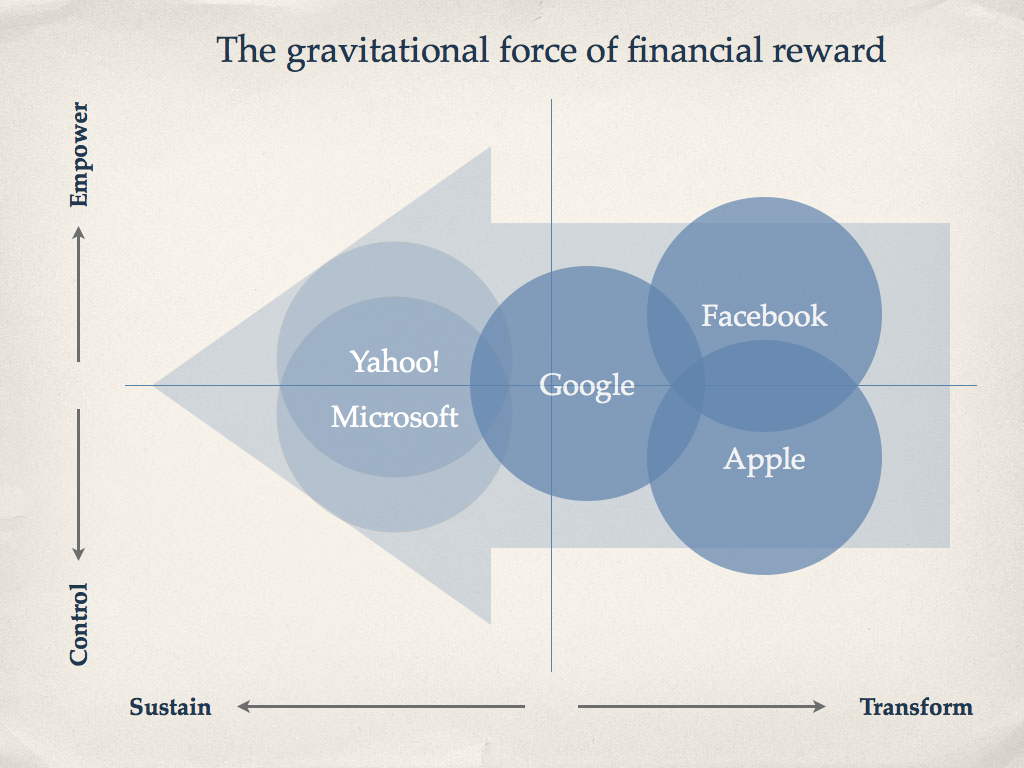

The power of money pulls many oganizations out of the worlds from which they were born into a place that ultimately values the status quo over change.

Now, this in and of itself is certainly not a bad thing. Â Too often, though, the financial motive drowns good intentions and changes the essence of an organization.

From the outside this is what seems to be happening to companies like Yahoo!, Microsoft and even Google.  It’s becoming the expected outcome for Facebook, but certainly not its destiny.

Interestingly, Apple has come back from that dangerous death spiral to irrelevance of the ‘sans Jobs’ years, but they’ve done it by focusing on transformation as a core value, a cultural flag in a sense.  As change is the interminable force driving technological advancement, it makes sense to have an intentional approach to it if you are a technology company…and even if you’re not.

This argument doesn’t suggest that more closed organizations like Apple, Microsoft, News International, Disney, etc. are unsuccessful.  By most commercial measures they are all very successful, indeed.

Rather, this argument suggests that the characteristics of a closed approach to operating mean that change and growth are dependent on the organization’s achievements, it’s discoveries, it’s own capabilities against everyone else’s.

It means closed organizations operate on their own and compete for points of control. Â Winning comes at the expense of others.

The open approach means that change and growth happen by giving, by strengthening others, by creating spaces for opportunity.

The rewards for being successful as an open agent of change are profound.  By valuing utility, service, relationships, tangible impact and effect over precision, being right, process and method you become part of a larger, deeper, more meaningful change in people’s lives.

This is not to say that operating on the edge of change doesn’t also have commercial value.  Being first to market has huge financial advantages if they are played correctly.

I might argue, actually, that being an open organization focused on change is no different than a closed organization in terms of how to approach building commercial value.

If you are not on the edge of change then you are more susceptible to the intense pull of the change-resistant markets sucking you back the other direction. Â In that case, you risk losing focus on your intentions and instead become focused exclusively on cash rewards to survive.

Then without a Mr. Jobs to recenter your target on the future your options close down in front of you very quickly.

Value in open organizations operating at large scale, therefore, is created through healthy relationships with others, by giving value to them, by creating value for new partnerships, opening opportunties on the edge of change.

In return, if it is in fact uniquely useful, the open organization becomes a dependency for its customers and partners. Â And that is a position of strength with many positive commercial outcomes.